- Pleasant Grove Independent School District

- Tax Impact

xxBond 2022 (do not delete)

Page Navigation

Tax Impact

-

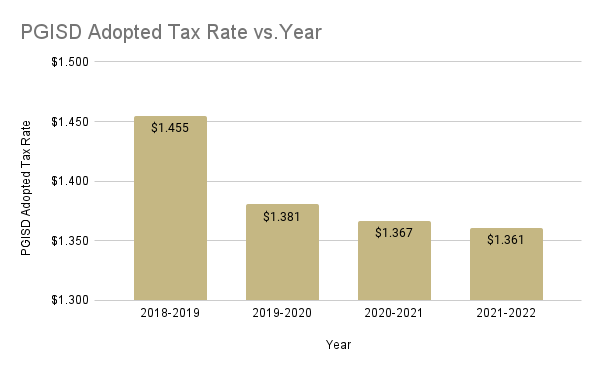

- The 2022 Bond proposal will cause no increase to the school district tax rate.

- Unless the property owner makes significant improvements to their property, homeowners 65 years of age and older will see no increase in their Pleasant Grove ISD property tax bill, now or in the future, if they have filed for their senior citizen homestead exemption.

What is the tax rate history of Pleasant Grove ISD?