- Pleasant Grove Independent School District

- Financial Documents

Financial Services

Page Navigation

- Financial Services

- Board of Trustees

- Budget Documents

- Business Office/Financial Documents (must be signed into Google for access)

- Conflict of Interest & Disclosure of Interested Parties

- Financial Documents

- Payroll & Benefits

- Public Information Request

- Purchasing & Vendor Information

- Purchasing Cooperatives

- Tax Information

Financial Documents

-

Pleasant Grove ISD has increased its efforts to provide transparent financial information for all stakeholders of the District. We are focused on presenting financial reports and relevant information in a format that is easily understandable and promotes transparency and accountability. Our goal is to provide our citizens and interested parties with the information necessary to better understand how their tax dollars are spent in support of student achievement.

Annual Financial Accountability Management Reports

-

The state’s school financial accountability rating system, known as the School Financial Integrity Rating System of Texas (FIRST), ensures that Texas public schools are held accountable for the quality of their financial management practices and that they improve those practices. The system is designed to encourage Texas public schools to better manage their financial resources to provide the maximum allocation possible for direct instructional purposes.

Annual Comprehensive Financial Reports (ACFR)

-

Each year, a school district must prepare its annual financial statements, have them audited by a licensed independent CPS firm, and submit the resulting audited annual financial and compliance report to the Texas Education Agency for review. The Annual Comprehensive Financial Report or ACFR, formerly called Comprehensive Annual Financial Report (CAPR), is due no later than 150 days after the close of a district’s fiscal year. Pleasant Grove ISD’s fiscal year ends on August 31 and our ACFR is due to TEA on or before January 28 of each year.

- 2022-2023 Comprehensive Annual Financial Report

- 2021-2022 Comprehensive Annual Financial Report

- 2020-2021 Comprehensive Annual Financial Report

- 2019-2020 Comprehensive Annual Financial Report

- 2018-2019 Comprehensive Annual Financial Report

- 2017-2018 Comprehensive Annual Financial Report

- 2016-2017 Comprehensive Annual Financial Report

- 2015-2016 Comprehensive Annual Financial Report

- 2014-2015 Comprehensive Annual Financial Report

- 2013-2014 Comprehensive Annual Financial Report

- 2012-2013 Comprehensive Annual Financial Report

- 2011-2012 Comprehensive Annual Financial Report

Disbursement Reports (Check Registers - Raw Format)

-

In an effort to provide transparency, the District provides current disbursement reports for the working fiscal year as well as a complete 12-month report for three prior fiscal years. These reports include the check date, payee, and check amount for each disbursement.

Financial Transparency Summary

-

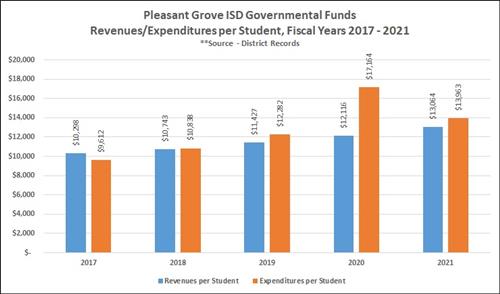

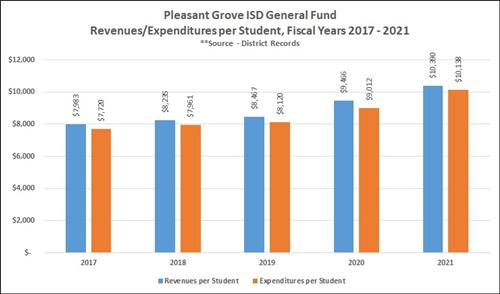

The following summary data is from the Governmental Funds Statements in the district's most recent Annual Comprehensive Financial Report (ACFR). The Governmental Funds include the district's primary operating fund (i.e. General Fund), Special Revenue Funds, Debt Service Fund, and Capital Projects Fund. The District's ACFRs in their entirety are located above.

PGISD Debt Transparency Information

All Governmental Funds

2020-2021 All Governmental Funds Financial Summary Data

2017-2021 All Governmental Funds Revenues/Expenditures Chart

General Funds

2020-2021 General Funds Financial Summary Data

2017-2021 General Funds Revenues/Expenditures Chart

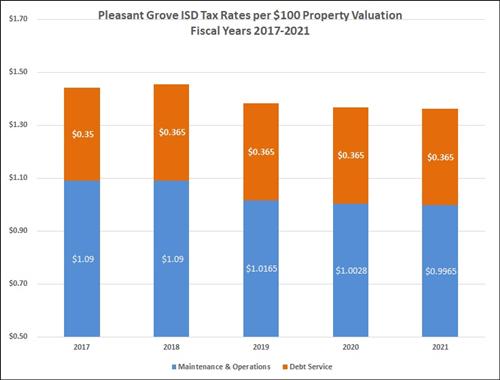

Property Tax

Tax Rates per $100 Valuation for Last Five Years, 2017-2021

Average Property Tax Revenue per Student for Last Five Years, 2017-2021