- Pleasant Grove Independent School District

- Frequently Asked Questions

xxBond 2022 (do not delete)

Page Navigation

-

Frequently Asked Questions

Planning Process and Community Committee Members

-

How did Pleasant Grove ISD determine the scope of the bond package?

A Community Committee on School Facilities met six times from November 2021 to February 2022 to study the district’s needs and made a recommendation to the Pleasant Grove ISD Board of Trustees on Friday, February 11, 2022. The Community Committee on School Facilities consisted of parents, grandparents, and business and community leaders who live in Pleasant Grove ISD and are vested in the community. The Community Committee on School Facilities reviewed all current Pleasant Grove ISD facilities, financial data, current academic needs, and projected student growth before presenting a recommendation to the Board of Trustees.Additionally, the Texas Association of School Boards (TASB) provided a comprehensive Facilities Assessment in November 2021. District staff provided facilities input through a district-wide staff survey.

Committee Members: Michael Galvan -C-, Ashley Gibbs, Edward Gill, Jaren Horton, Cole Meador - C, Brock McCorkle, Kelli Phillips, Cheney Pruitt, Barbara Washington, Aven Williamson, Jennifer Wright.

What will be included in the 2022 bond proposition?

-

The proposition is a $39.9 million bond to do the following:

- New high school cafeteria

- High school remodel of the current cafeteria for College and Career Counseling Center

- Additions to the high school performing arts center (scene shop and storage) and sound booth relocation

- Band hall upgrades

- New high school field house including classroom space, boys & girls locker rooms, and sports medicine facilities

- New high school baseball/softball/track complex located at Pleasant Grove High School

- High school renovations in the library, restrooms, hallways, and common areas

- Significant renovations to Pleasant Grove Middle School including improved functionalities, roof, HVAC, interior and exterior updates

- Intermediate school classroom additions

- Intermediate school renovations to library and general interior/exterior updates

Tax Impact

-

- The 2022 Bond proposal will cause no increase to the school district tax rate.

- Unless the property owner makes significant improvements to their property, homeowners 65 years of age and older will see no increase in their Pleasant Grove ISD property tax bill, now or in the future, if they have filed for their senior citizen homestead exemption.

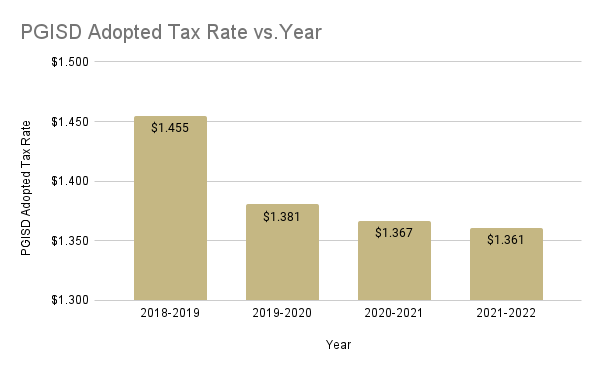

What is the tax rate history of Pleasant Grove ISD?

Questions

-

Who do we contact if we want more information about the bond referendum?

For more information, please contact the district at communications@pgisd.net or 903-831-4086.Pleasant Grove ISD will continue to update this page with information regarding the 2022 bond proposition.